~ Live Market Practice & personalized mentorship

🌟 Why Do You Need Mentor Support in the Stock Market? — Guided Learning & Lifetime Mentorship with Nirman Institute of Financial Awareness (NIFA), Bhopal

“गुरु बिन ज्ञान अधूरा” — Without the guidance of a mentor, knowledge always remains incomplete.

Nowhere is this truer than in the world of stock trading — a space that excites, challenges, and often confuses even the best of minds. The financial market may look like a playground for profit, but without proper guidance, it can quickly become a maze of uncertainty.

Even the legendary Warren Buffett had a mentor — Benjamin Graham, The Father of Value Investing — whose wisdom became the cornerstone of Buffett’s success.

Learning stock trading without a mentor is like swimming in deep water without a coach — possible, but risky. A mentor doesn’t just teach you techniques; they share real experiences, help you avoid costly mistakes, and build your discipline for the long run.

💡 Why Practical Mentorship Outweighs Theoretical Learning

The stock market changes faster than any textbook can update.

While theory tells you what to do, a mentor shows you when and how to act.

Real success depends on decision-making — something only practical exposure can teach.

At Nirman Institute of Financial Awareness, mentorship connects classroom learning with live market practice, turning knowledge into confident, consistent trading.

1️⃣ Strengthening Your Core Foundation

Many beginners rush to master advanced strategies but skip the basics.

A mentor ensures you understand every core concept — from PE ratios and moving averages to dividend yields — with absolute clarity.

At Nirman Stock Market Institute, certified mentors begin with the fundamentals so every learner develops logical reasoning and financial discipline — not a habit of guesswork.

“Knowledge creates skill, but mentorship builds wisdom.”

2️⃣ Making Complex Market Concepts Simple

The market is a blend of numbers, emotions, and unpredictable movements.

Without proper guidance, it’s easy to get lost.

Mentors at Nirman Institute break down every concept — from RSI and MACD to candlestick interpretation — into practical, hands-on lessons. You don’t just learn indicators; you understand how to apply them in real trading situations.

3️⃣ Learning to Avoid Costly Trading Mistakes

Statistics show that more than 90% of traders lose money due to emotional trading and poor guidance.

Common beginner errors include:

-

Acting on rumors or “hot tips”

-

Ignoring stop-loss and risk limits

-

Trading out of greed or fear

At Nirman Institute, you learn to trade systematically — with research, strategy, and discipline. Our mentors shape students into thinkers, not reactors, preparing them to trade with confidence even during market volatility.

4️⃣ Developing the Mindset of a Disciplined Trader

“Successful investing takes time, patience, and discipline.” — Warren Buffett

That’s the very principle Nirman mentors instill in every student.

Through personalized mentorship, learners create trading plans aligned with their risk profile and goals.

Discipline becomes a habit — not a rule — resulting in traders who achieve consistency before profits.

5️⃣ Mastering Trend Reading & Market Analysis

Recognizing patterns and trends is the real game-changer in trading.

Our mentors train you to:

-

Understand demand-supply dynamics

-

Identify high-growth sectors

-

Combine technical and fundamental analysis for timing trades

With live market sessions, NIFA mentors ensure that learning is never limited to theory but rooted in real-time market understanding.

6️⃣ Building Confidence and Emotional Strength

The two biggest enemies of a trader? Fear and greed.

Mentors help students manage emotions and stick to logic-based decisions.

Losses are treated as lessons, and wins as results of discipline — creating emotionally strong traders who remain calm under pressure.

7️⃣ Escaping the Trial-and-Error Trap

Experimentation in trading can be expensive.

A mentor protects you from unnecessary risks by sharing tested techniques.

At NIFA, mentors teach what works in real markets — helping students develop profitable, time-tested strategies while saving them from the cost of avoidable mistakes.

8️⃣ Accountability, Support, and Lifelong Learning

Trading can often feel isolating — but not when you have a lifelong guide.

Nirman Institute’s Lifetime Mentorship Program provides continuous guidance, trade reviews, and access to a supportive trading community. Whether you’re confused about a setup or need motivation, your mentor is always there to bring you back on track.

9️⃣ Learning the Art of Risk Management

Professional traders focus on capital protection first, profits second.

Our mentors emphasize:

-

Smart stop-loss placement

-

Portfolio diversification

-

Controlling emotions in volatile markets

At NIFA, risk management isn’t a module — it’s a mindset. Students learn to protect their capital before chasing returns.

🔹 The Power of True Mentorship

From Dronacharya and Arjun to Benjamin Graham and Warren Buffett, history has shown that great mentors create great achievers.

At Nirman Institute of Financial Awareness, mentors are not mere instructors — they’re lifelong guides who empower students through real-world experience, discipline, and financial awareness.

A mentor doesn’t just teach — they transform your potential into mastery.

In Indian tradition, the Guru is considered next to God, as poet Kabir Das beautifully said:

“Guru Gobind dou khade, kake lagoon paye,

Balihari Guru aapne, Govind diyo bataye.”

This means: When both Guru and God stand before me, I bow first to my Guru — for he showed me the path to God.

This philosophy perfectly reflects NIFA’s mission — to be the guiding force for every aspiring trader.

How to Choose the Right Stock Market Mentor ?

Now that we know a mentor can transform your entire trading and investment journey—saving you from common pitfalls, and keeping you patient, disciplined, and confident while teaching you the best trading setups—how do you select the right mentor for yourself? Here are a few key qualities to look for in a stock market mentor who suits your needs:

🔍 How to Choose the Right Stock Market Mentor

Since the right mentor can completely transform your trading journey, here are some key factors to consider:

1️⃣ Define Your Financial Goals

Decide whether you aim for long-term wealth creation or short-term trading growth.

2️⃣ Check Proven Experience

An experienced mentor is like a seasoned doctor — they’ve seen it all and know what works.

3️⃣ Evaluate Teaching Style

A good trader isn’t always a good mentor. Attend demo sessions first to understand their teaching style.

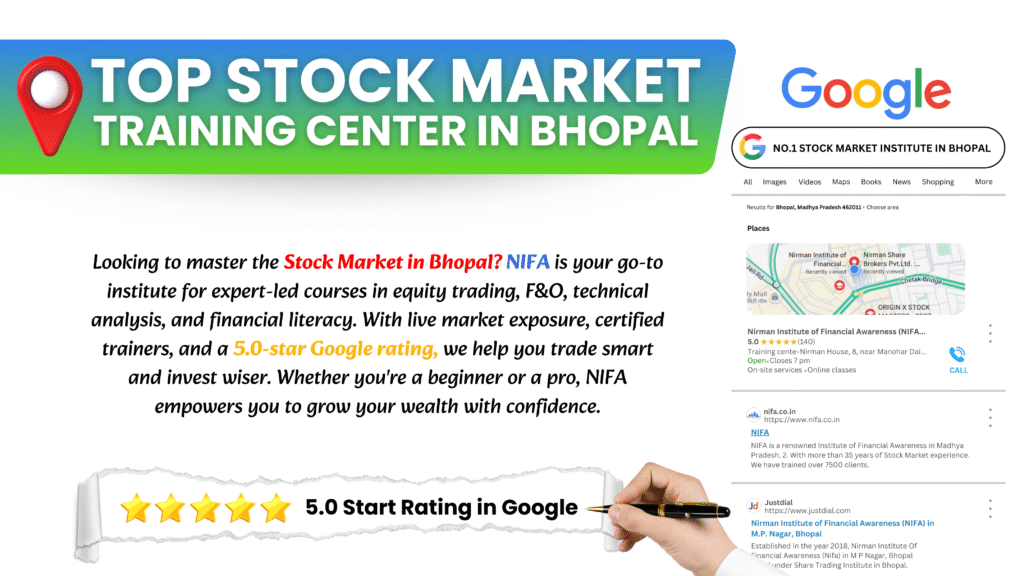

NIRMAN INSTITUTE offers free demo classes for beginners to experience quality learning before joining.

4️⃣ Look for Credibility and Transparency

Avoid anyone promising “overnight profits” or “100% success.” A genuine mentor sets realistic expectations and emphasizes patience and process.

5️⃣ Choose Based on Expertise

Whether your interest lies in Technical Analysis, Fundamental Research, or Trading Psychology, choose a mentor specializing in your preferred area.

6️⃣ Seek Personalized Mentorship

Every learner is different. At NIRMAN INSTITUTE, mentors track individual progress and guide students with tailor-made strategies and lifetime access to mentorship channels.

7️⃣ Verify Testimonials

Always check reviews and feedback from past learners to ensure authenticity.

8️⃣ Focus on Practical Success

Ensure your mentor trades successfully themselves — it reflects their market understanding, not just theoretical knowledge.

9️⃣ Value Expertise Over Earnings

Don’t be swayed by high-income claims. Focus on the mentor’s ability to teach, simplify, and guide.

🧠 Key factors that effect in mentorship

When selecting a mentor, look for:

✅ Proven experience and credibility

✅ Simplified teaching style

✅ Real-time mentorship and lifetime access

✅ Practical, not theoretical, knowledge

✅ Personal attention and honest feedback

At Nirman Institute, each student receives:

-

Personalized mentorship tailored to learning pace and goals

-

Free demo classes to experience real learning

-

Lifetime access to mentorship & trading communities

✅ Why Choose Nirman Institute of Financial Awareness

At NIFA, every learner receives:

-

Personalized mentorship and real-time feedback

-

Free demo sessions to understand the stock market basics

-

Lifetime guidance and access to trading communities

-

Focus on practical trading, emotional control, and disciplined decision-making

-

Conclusion — The Real Investment is in Mentorship

In the unpredictable world of stock markets, your first and most valuable investment is not a stock — it’s your mentor.

A mentor helps you:

-

Avoid emotional decisions

-

Build trading discipline

-

Manage risk effectively

-

Grow continuously with confidence

At Nirman Institute of Financial Awareness, our Lifetime Mentorship Program bridges learning and success — empowering students to become confident, consistent, and independent traders.

At NIFA, we don’t just teach trading —

We nurture traders who think, act, and succeed like professionals.